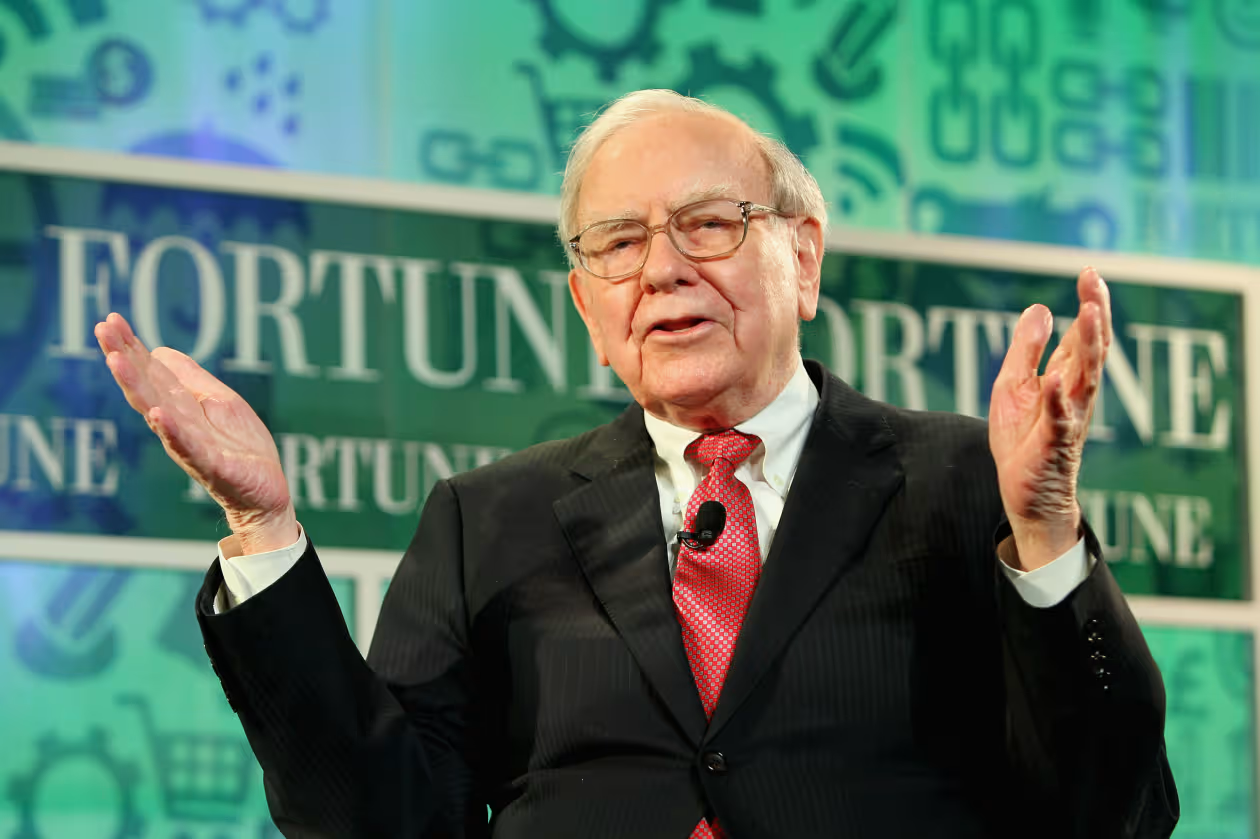

Omaha, Nebraska — As Warren Buffett approaches the final months of his tenure as CEO, Berkshire Hathaway has amassed a record-setting cash reserve of $381.7 billion, signaling a cautious approach to investment even amid strong profitability.

The conglomerate reported a rise in net income of 17%, reaching approximately $30.8 billion for the third quarter, while operating profit climbed 34% to $13.5 billion. Despite these gains, revenue growth was modest at around 2%, reflecting a more restrained market environment and ongoing challenges in deploying capital effectively.

What the Cash Pile Indicates

Berkshire’s massive cash reserve highlights a deliberate strategy: management is carefully evaluating opportunities rather than rushing into acquisitions. The company has consistently sold more stock than it has bought over the past year and has refrained from significant share repurchases for five consecutive quarters.

The cash cushion provides flexibility for the incoming leadership. Greg Abel, set to assume the CEO role following Buffett’s retirement, will have unprecedented resources at his disposal. However, the question facing Berkshire is how to deploy such a vast amount in ways that preserve value and meet shareholder expectations.

Implications for Investors

While Buffett’s reputation has earned investor trust for decades, the enormous cash balance has raised questions about capital allocation. The company’s stock has underperformed broader market indices in recent months, adding pressure to use the funds either for strategic acquisitions or shareholder returns.

Investors will closely watch whether Berkshire will:

- Initiate dividends for the first time in decades,

- Pursue large-scale acquisitions, or

- Continue holding the cash in anticipation of more attractive market opportunities.

Strategic Philosophy Endures

Even with this record cash pile, Berkshire’s core investment philosophy remains unchanged: prioritize opportunities that clearly increase intrinsic value rather than chase short-term gains. The cautious stance reflects confidence in long-term planning and patience, traits that have defined Buffett’s leadership for nearly sixty years.

Final Thoughts

Berkshire Hathaway’s record cash position underscores both opportunity and challenge. It is a demonstration of prudence, but also a test for the next generation of leadership. How the company deploys this unprecedented capital will shape its trajectory for years to come, marking the next chapter in one of the world’s most storied corporate legacies.

Leave a Reply