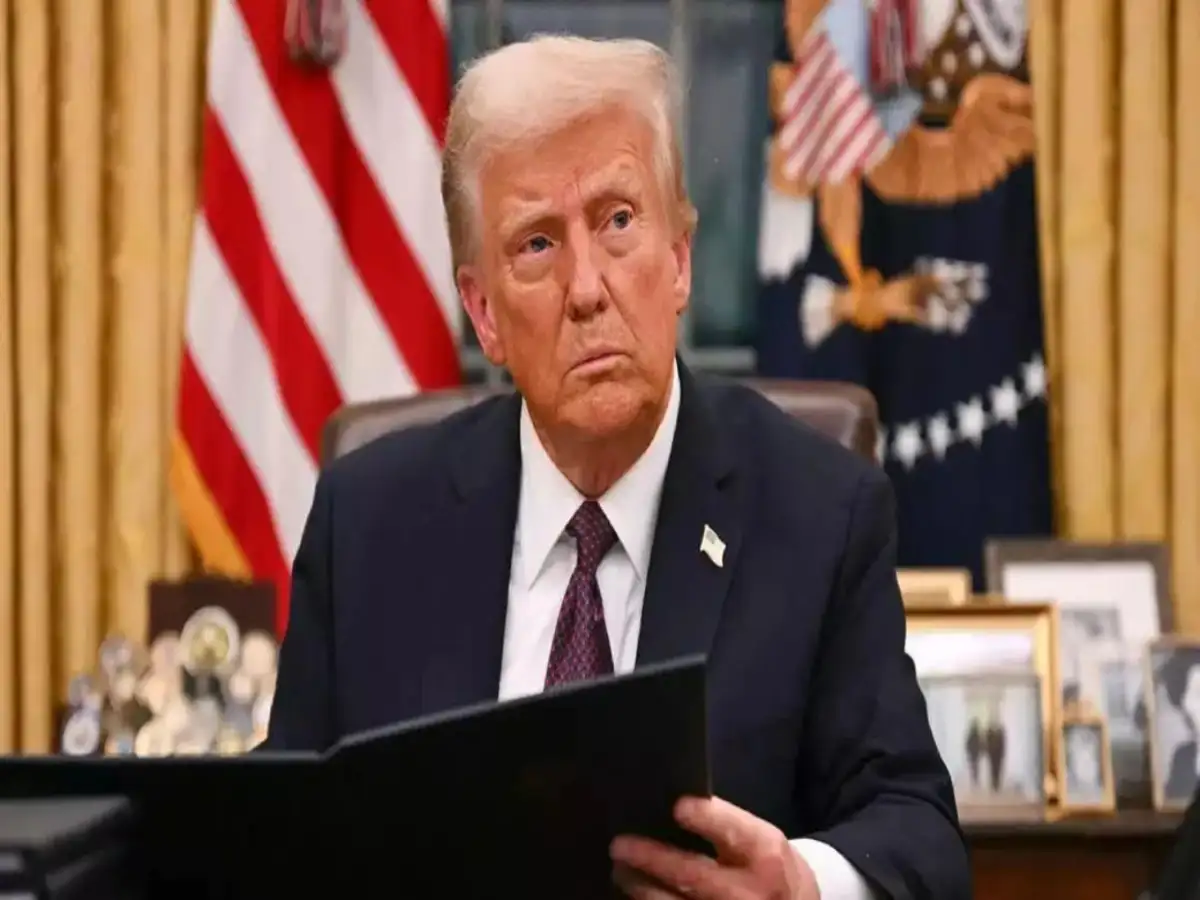

Global financial markets moved cautiously on Thursday as investors digested a complex mix of geopolitical developments, corporate earnings, and central bank signals. The focal point was the high-profile meeting between U.S. President Donald Trump and Chinese President Xi Jinping, which concluded with a tentative agreement aimed at easing long-standing trade tensions between the world’s two largest economies.

Trump-Xi Deal: A Step Toward Stability?

The Trump-Xi meeting resulted in a deal that could reshape aspects of the U.S.-China economic relationship. According to the agreement, the United States will ease certain tariffs on Chinese imports, while Beijing has pledged to resume purchasing U.S. soybeans and maintain stable exports of critical rare earth minerals. Both nations also agreed to intensify cooperation against illegal fentanyl trade.

While the announcement sparked initial optimism, analysts remain cautious. Past trade negotiations have often faltered during implementation, and some investors are concerned that political pressures on both sides could hinder the deal’s full execution. “Markets are taking a wait-and-see approach,” said one strategist. “The headline is positive, but real effects depend on follow-through.”

Corporate Earnings Cloud Investor Sentiment

Adding to the market’s cautious tone, corporate earnings reports provided a mixed picture of economic momentum. Technology giants Microsoft and Meta reported quarterly results that fell short of analysts’ expectations. Microsoft’s revenue growth slowed compared to previous quarters, while Meta faced continued challenges in its advertising business. Shares of both companies declined sharply in after-hours trading, with Meta losing around 8% and Microsoft down roughly 2%.

European markets reflected similar caution. The pan-European STOXX 600 index dropped 0.5%, with technology and industrial sectors leading the losses. Investors cited concerns that slowing global demand and rising input costs could continue to pressure corporate earnings in the months ahead.

Central Banks and Currency Movements

Currency and bond markets were also influenced by central bank policies. The U.S. Federal Reserve’s recent interest rate cut, coupled with indications that further reductions are not guaranteed, contributed to rising Treasury yields and a stronger U.S. dollar. The Bank of Japan, meanwhile, kept interest rates unchanged, maintaining its cautious stance in the face of weak inflationary pressure, which led to a softer yen against major currencies.

Emerging markets were not immune to these dynamics. The Chinese yuan saw modest gains following the trade deal announcement, but investors remain wary of potential volatility due to broader global economic uncertainty.

Investor Sentiment and the Road Ahead

Overall, market sentiment remains mixed. While the Trump-Xi agreement represents a rare instance of positive geopolitical news, it is counterbalanced by disappointing corporate earnings and the ongoing challenge of navigating central bank policies. Investors are closely watching upcoming economic indicators, including U.S. employment data and European inflation figures, to gauge the resilience of the global economy heading into 2026.

Analysts suggest that volatility is likely to persist in the near term. “We’re in a period where markets respond sharply to both political developments and economic data,” noted a financial strategist. “Investors need to balance optimism from trade progress with caution over economic fundamentals.”

Conclusion

As the world enters the final months of 2025, markets are navigating a delicate balance of optimism and caution. The Trump-Xi trade deal provides a potential catalyst for stability, yet uncertainties around corporate earnings, central bank policy, and global economic growth continue to weigh on investor sentiment. Market participants are bracing for a period of heightened volatility, recognizing that the path ahead may be shaped as much by political and policy decisions as by economic fundamentals.

Leave a Reply