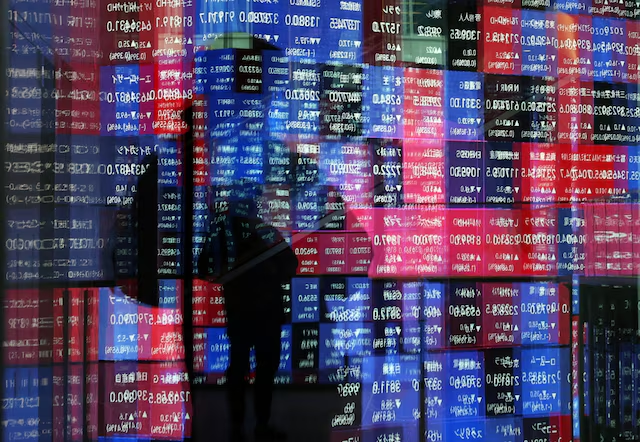

Japan’s government bond yields jumped sharply following a policy shift by the Bank of Japan (BOJ), while U.S. stock futures signaled a positive start on Wall Street, highlighting diverging monetary paths between the world’s major economies.

The BOJ’s decision to raise interest rates marked another step away from its long-standing ultra-loose monetary stance. The move immediately pushed yields on Japanese government bonds higher, with investors reassessing expectations for inflation, borrowing costs, and future policy tightening. Analysts said the reaction underscored how sensitive Japan’s bond market remains after years of yield suppression and central bank intervention.

Higher yields reflect growing confidence that inflation in Japan is no longer purely temporary. Rising wages, firmer consumer prices, and sustained economic activity have strengthened the case for gradual normalization. However, the sudden jump also raised concerns about volatility, particularly given the BOJ’s outsized presence in the bond market after years of large-scale purchases.

In contrast, sentiment in the United States appeared more upbeat. Wall Street was poised for gains as investors focused on resilient corporate earnings and signs that the U.S. economy remains strong despite higher interest rates. Market participants also drew comfort from expectations that the Federal Reserve may be nearing the end of its tightening cycle, even as it keeps policy restrictive.

The divergence between Japan and the U.S. has also influenced currency markets. The yen showed signs of strengthening after the BOJ’s move, easing some pressure that had built up during periods of extreme weakness. A firmer yen could help reduce imported inflation in Japan but may weigh on exporters if the trend continues.

Global investors are now weighing the broader implications of Japan’s shift. For years, Japan’s low yields pushed capital overseas in search of higher returns. Rising domestic yields could begin to reverse some of those flows, potentially affecting global bond markets and asset prices.

Economists cautioned that while the BOJ’s hike is symbolically significant, policy remains accommodative by international standards. Further increases are expected to be gradual and data-dependent, aimed at avoiding shocks to growth or financial stability.

As trading continues, markets are likely to remain sensitive to central bank signals on both sides of the Pacific. Japan’s bond surge and Wall Street’s optimistic tone together reflect a global economy in transition, where policy divergence is becoming a defining feature of the financial landscape.

Leave a Reply