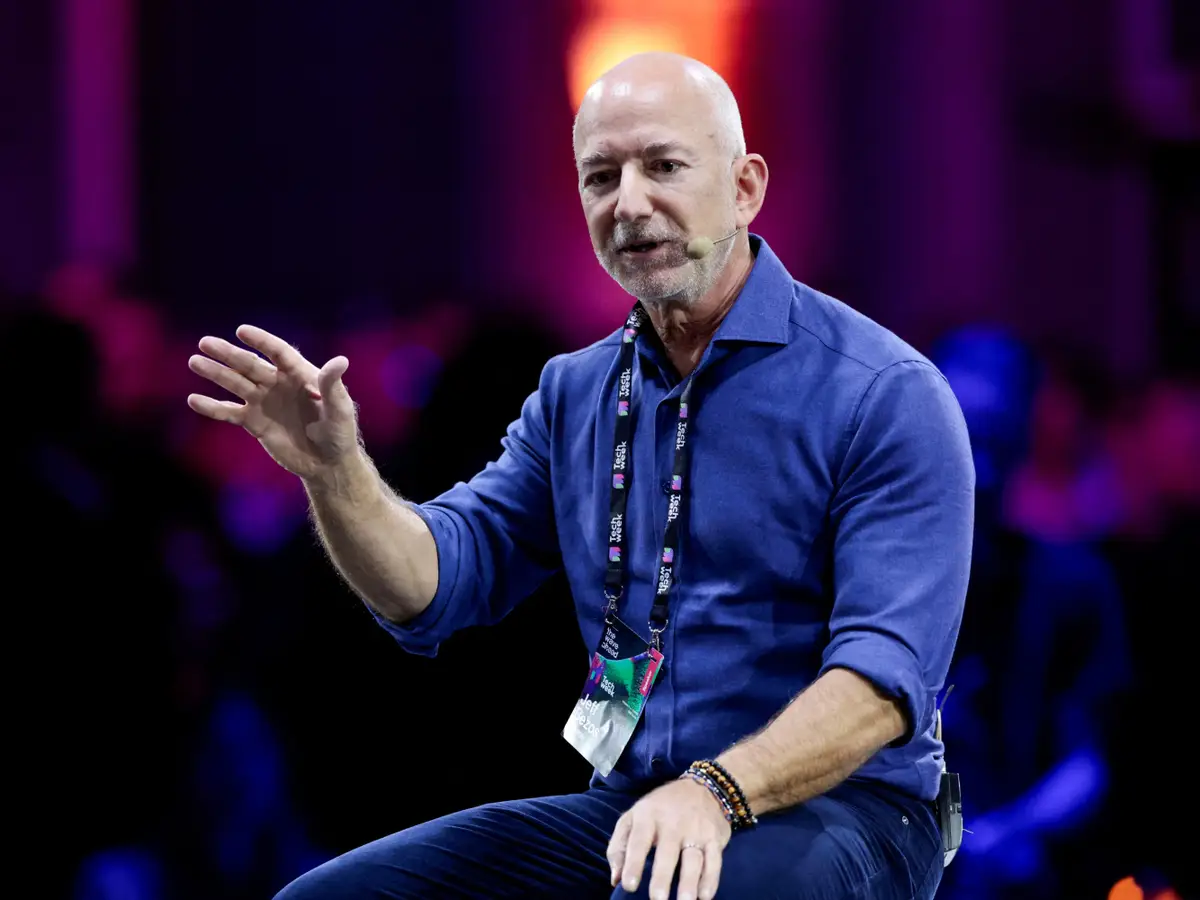

At Italian Tech Week in Turin, two of the world’s most influential business figures — Jeff Bezos, founder of Amazon, and David Solomon, CEO of Goldman Sachs — offered starkly contrasting yet complementary warnings about the rapid pace of investment in artificial intelligence. Their remarks underscored growing concern that the global AI boom could be inflating a speculative bubble with far-reaching financial consequences.

Bezos and Solomon, both veterans of previous market cycles, framed the AI surge as both a remarkable technological revolution and a financial risk that could soon test investor discipline. While they expressed confidence in AI’s transformative potential, both men suggested that exuberant market behavior may be pushing valuations and expectations into unsustainable territory.

Jeff Bezos: “An Industrial Bubble That Might Do Some Good”

Jeff Bezos, who has long emphasized the value of long-term innovation over short-term gain, acknowledged that much of the current enthusiasm around AI resembles a bubble — but one he believes may ultimately prove beneficial.

“Every major technological revolution comes with a speculative phase,” Bezos said. “Yes, we’re probably in a bubble, but not all bubbles are bad. Industrial bubbles can leave behind the infrastructure and knowledge that power the next phase of progress.”

The Amazon founder likened today’s AI wave to previous periods of excessive optimism — including the dot-com boom of the late 1990s and the railway mania of the 19th century. In both cases, a surge of investment created unsustainable short-term valuations, yet also produced enduring foundations for future industries.

“Even when the hype collapses,” Bezos explained, “what remains are the tools, platforms, and skilled people that move society forward.”

Bezos also cautioned against what he described as “blind capital,” where investors chase buzzwords rather than tangible progress. “There are too many AI startups that have a name, a pitch deck, and a vague promise of disruption — but not enough working code or real product-market fit,” he said. “That’s where investors need to be careful.”

David Solomon: “The Drawdown Is Coming”

Goldman Sachs CEO David Solomon echoed Bezos’s caution, predicting that financial markets are heading toward what he termed a “drawdown” — a period of correction and disillusionment following excessive optimism.

“I wouldn’t call it a bubble just yet,” Solomon said, “but the conditions are there for a significant adjustment. We’ve seen valuations stretch across the AI sector, and it’s hard to believe all that capital will yield proportional returns.”

Solomon emphasized that, while AI has the potential to transform productivity and efficiency across industries, investors are overestimating how quickly those benefits will materialize. “The timelines are long, the infrastructure costs are massive, and not every company claiming to be AI-driven really is,” he said.

According to Solomon, the next one to two years could bring market corrections, especially in speculative segments of the tech industry. He warned that such a drawdown would not signal the end of AI innovation, but rather a necessary phase of consolidation where weaker firms fail and stronger ones emerge.

“Every disruptive cycle has its shakeout,” he added. “The winners will be those with real technological depth and sustainable business models.”

A Meeting of Perspectives: Productive Innovation Meets Financial Reality

Bezos and Solomon, though coming from different worlds — one a tech pioneer, the other a Wall Street strategist — converged on a shared message: AI’s promise is real, but so is the danger of financial overreach.

Their remarks reflect a growing tension between two realities shaping the global economy:

- On one hand, AI breakthroughs in generative models, automation, and machine learning have redefined industries from logistics to finance.

- On the other, speculative euphoria has led to unsustainable valuations, with investors pouring billions into ventures that may not survive the next few years.

Bezos noted that the structure of this bubble differs from past ones in that it is “industrial” rather than purely financial. That distinction, he argued, means that even if markets overheat, the underlying technological ecosystem — including chip design, data infrastructure, and talent development — will continue to yield lasting benefits.

“People will lose money,” Bezos said bluntly. “But humanity will gain capability.”

Lessons from History: The Dot-Com Parallel

Both leaders invoked the memory of the dot-com crash of 2000, when speculative mania around internet companies led to massive losses but also paved the way for giants like Amazon, Google, and eBay.

Bezos, who founded Amazon in 1994 and survived that collapse, reminded the audience that bubbles often accelerate development by flooding sectors with capital and talent. “The dot-com crash wiped out 90% of the players,” he recalled, “but it also gave us the infrastructure — fiber optics, cloud systems, broadband — that built today’s digital economy.”

Solomon agreed, though with a more measured tone. “The internet didn’t disappear after 2000. But it took time for its full impact to be realized,” he said. “AI will be the same. We’ll have a period of overbuilding and correction before the true value becomes clear.”

Market Implications and Investor Sentiment

Global financial markets have surged this year on the back of AI optimism, with tech-heavy indices reaching record highs. Investors are betting heavily on companies seen as AI leaders — from semiconductor manufacturers to cloud providers and software startups.

However, some analysts are warning that these valuations are increasingly detached from near-term earnings potential. Corporate spending on AI infrastructure has soared, but revenue growth in many cases has yet to match expectations.

Goldman Sachs recently published research noting that while AI could boost global GDP by as much as 7% over the next decade, the transition will not be linear. In the near term, volatility, overinvestment, and competitive pressures could weigh on returns.

The Human and Ethical Dimension

Beyond financial implications, both Bezos and Solomon touched on the societal impact of AI, emphasizing that the technology’s true challenge will be managing disruption in labor markets and ethics.

Bezos suggested that governments and corporations must anticipate “massive dislocation” in certain job categories, particularly those centered on routine data processing and administrative work. “We must invest as much in retraining and adaptation as we do in computation,” he said.

Solomon added that AI’s influence on decision-making — particularly in banking, risk management, and hiring — would require new regulatory and ethical frameworks. “The question isn’t whether AI will change how we work,” he said. “It’s whether we can make those changes responsibly.”

A Shared Message: Innovation with Caution

Despite their differing levels of optimism, both Bezos and Solomon agreed that the world stands on the brink of an epochal transformation — one that will test the discipline of investors and the foresight of policymakers.

“AI is not a trend; it’s a platform shift,” Bezos concluded. “But platforms evolve over decades, not months. Investors and builders alike must be patient.”

Solomon echoed that sentiment with a final warning: “When everyone believes they’re investing in the future, markets can forget how to measure the present. That’s when reality tends to reassert itself.”

As AI continues to reshape the global economy, their combined voices serve as both a reality check and a reminder that progress often comes wrapped in speculation — and that even the smartest technologies can’t rewrite the laws of economics.

Leave a Reply