European stock markets were poised for a subdued start to trading as investors weighed persistent geopolitical uncertainty alongside a mixed economic backdrop. After a period of relatively steady gains, sentiment has turned more cautious, with traders reluctant to take on fresh risk amid shifting global political signals and questions about the strength of regional growth.

Futures tracking major European indexes pointed to a flat or slightly negative open, suggesting that markets may struggle to build momentum in the early part of the session. The hesitant tone follows a stretch of choppy trading in which gains have been capped by concerns over international relations, trade policy risks, and uneven economic performance across the euro area.

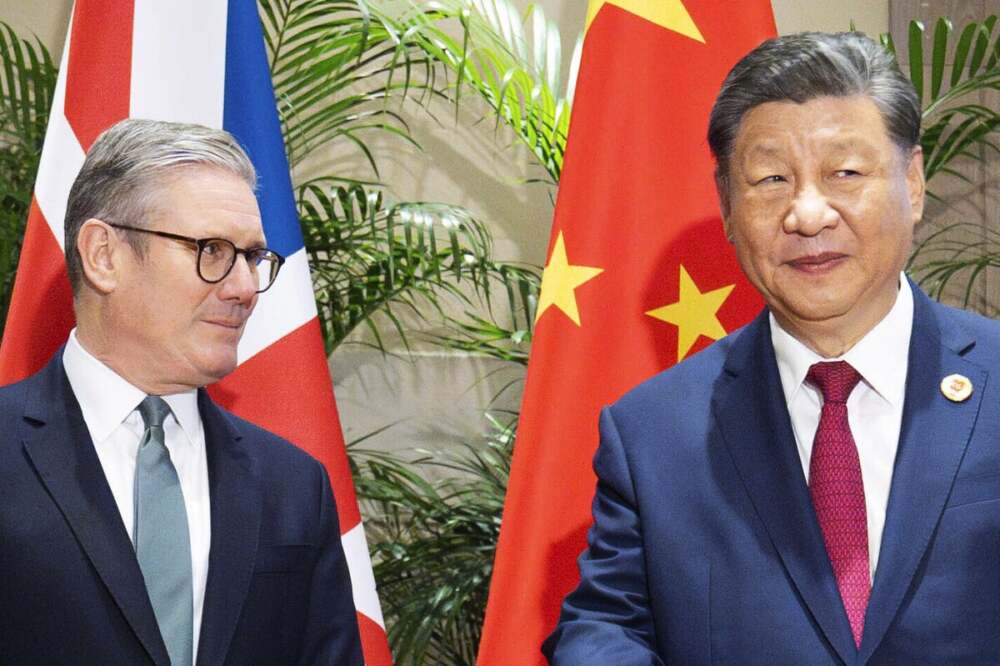

Geopolitics remains front and center for investors. Diplomatic friction involving the United States and key global partners has injected fresh uncertainty into markets that were already navigating a fragile recovery. While none of the current tensions have yet translated into concrete economic disruptions, the possibility of trade measures, sanctions, or policy retaliation has made investors more defensive. Market participants are increasingly sensitive to political headlines, which can trigger rapid shifts in sentiment even in the absence of hard data.

At the same time, economic signals from Europe have offered a mixed picture. Recent data has shown pockets of resilience, particularly in consumer activity in some countries, but overall growth remains modest. Manufacturing activity in several eurozone economies continues to face headwinds from weaker global demand and higher borrowing costs compared with previous years. Services sectors have fared better, though momentum there has also cooled compared with earlier rebounds.

Investors are now closely watching upcoming economic releases for clearer direction. Surveys on business activity, consumer confidence, and retail performance are expected to help shape expectations for the first quarter. Any signs of renewed weakness could reinforce the view that Europe’s recovery remains fragile, while stronger-than-expected numbers might provide a short-term lift to equities.

Corporate earnings are also playing a key role in shaping market mood. Companies across sectors have been offering cautious guidance, reflecting uncertainty over input costs, demand trends, and currency movements. Export-oriented firms, in particular, are vulnerable to shifts in global trade dynamics and exchange rates. Meanwhile, defensive sectors such as utilities and healthcare have attracted renewed interest from investors seeking relative stability.

Monetary policy remains another important piece of the puzzle. The European Central Bank has signaled a data-dependent approach, balancing easing inflation pressures against still-soft growth. While markets have priced in the possibility of rate cuts later in the year, policymakers have been careful not to commit to a firm timeline. This uncertainty over the path of interest rates is contributing to a wait-and-see attitude among equity investors.

Overall, European markets appear stuck in a holding pattern. Without a clear catalyst, either from stronger economic data or a meaningful easing of geopolitical tensions, equities may continue to trade in a narrow range. For now, caution is the dominant theme, with investors prioritizing risk management over aggressive positioning as they navigate an increasingly complex global landscape.

Leave a Reply