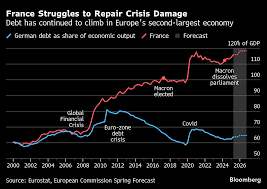

France, the eurozone’s second-largest economy, is facing mounting financial and political turbulence that has sparked concerns about the stability of the wider European Union. With debt levels spiraling and political divisions deepening, some analysts warn that the country could become the epicenter of the eurozone’s next major crisis.

Debt and Deficits on the Rise

France’s public debt has surged to over 110% of its GDP, putting it among the most indebted nations in Europe. At the same time, its budget deficit remains close to 6%—double the limit allowed under EU fiscal rules. These figures have raised alarm among investors, who are demanding higher returns on French bonds, pushing borrowing costs higher.

Political Uncertainty Fuels Market Jitters

The government of Prime Minister François Bayrou recently introduced a deficit-reduction package featuring spending cuts, tax increases, and even the cancellation of two national holidays. However, the plan triggered fierce backlash in parliament and is expected to fail in a confidence vote. If the government collapses, France could be thrown into another period of political paralysis, further eroding confidence in its ability to tackle the crisis.

Markets Eye Credit Ratings

Financial markets are bracing for potential downgrades to France’s credit rating. Any cut by major agencies could force institutional investors to sell French bonds, driving borrowing costs even higher. The country’s finance ministry has urged a compromise on the budget, warning that a failure to restore fiscal discipline could leave France vulnerable to a Greece-style crisis.

Ripple Effects Across Europe

France’s problems are not confined to its borders. As one of the largest economies in the eurozone, instability in Paris could easily spread to other member states through financial contagion. Rising French bond yields already risk destabilizing European banks and exposing weaknesses in the euro area’s financial architecture.

A Turning Point for the Eurozone

France’s predicament is being watched closely across Europe. If the political deadlock continues and economic reforms stall, the nation could quickly shift from being a pillar of the eurozone to its greatest liability. Some experts caution that unless decisive measures are taken, France might set off a chain reaction reminiscent of the debt crisis that shook the continent a decade ago.

Leave a Reply