As traditional investment avenues face persistent volatility, a growing number of financial advisors and retirement planners are turning their attention to private credit — a once niche segment of finance — as a compelling alternative for long‑term savers. Over the past year, private credit has gained traction among sophisticated investors and retirement strategists alike, fueled by historically low yields in public markets and evolving portfolio diversification needs.

What Is Private Credit and Why Now?

Private credit refers to direct lending to companies outside of public bond markets, typically facilitated by specialized investment firms or funds. Instead of buying publicly traded corporate bonds, investors in private credit provide loans directly to businesses — often with tailored terms and higher interest rates in exchange for assumed risk and reduced liquidity.

This asset class has expanded rapidly since the global financial crisis, as regulatory constraints on banks pushed corporate lending toward non‑bank lenders. In recent years, the appetite for private credit has grown further as investors seek yield enhancement and uncorrelated returns compared to traditional stocks and bonds.

Several factors are driving interest in private credit now:

- Low interest rate regimes over much of the past decade have squeezed returns on government bonds and high‑grade corporate debt.

- Equity market volatility has heightened risk awareness, prompting investors to explore alternatives that may provide steadier income streams.

- Institutional adoption by pension funds, endowments, and sovereign wealth funds has lent credibility and scale to the private credit market.

Attraction for Retirement Investors

Retirement planners are increasingly highlighting private credit for 401(k) plans and IRAs, particularly for savers seeking enhanced income without the full risk profile of equities. Proponents argue that private credit can offer:

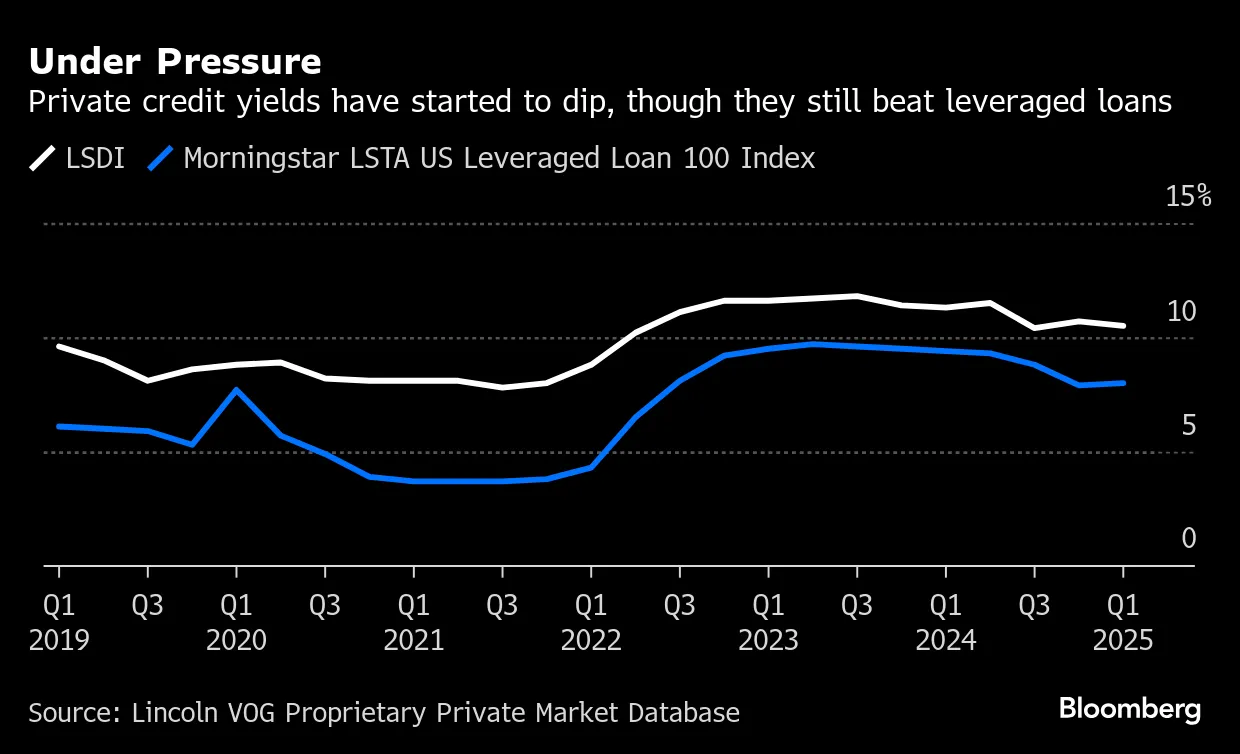

- Higher yields compared to comparable public fixed‑income instruments.

- Income diversification, buffering portfolios against stock market downturns.

- Potential inflation resilience, as many private credit deals include floating interest rates.

For retirees and pre‑retirees dependent on investment income, these features could help bridge the gap left by depressed yields on traditional bonds.

Balancing Risk and Reward

Despite its appeal, private credit is not without challenges. Unlike stocks and bonds traded on public exchanges, private credit investments are less liquid, meaning investors may have limited ability to exit positions quickly. This illiquidity requires a longer investment horizon — a consideration particularly relevant for retirement accounts where access to funds can become a priority.

Moreover, private credit carries credit risk, as loans are extended to companies that may not meet the strictest standards for publicly traded debt. Default risk can be higher, especially in economic downturns, and recovery rates in stressed scenarios can vary widely.

Financial advisors stress that private credit should not replace traditional assets outright, but instead act as a complementary allocation within a diversified retirement portfolio. Proper due diligence, risk assessment, and alignment with individual financial goals remain key.

How Investors Are Gaining Exposure

Individual retirement savers typically access private credit through funds or pooled investment vehicles, rather than direct lending relationships. These can include:

- Private credit mutual funds

- Business development company (BDC) shares

- Closed‑end funds specializing in direct lending

- Alternative income‑oriented ETFs that incorporate private credit strategies

Each structure carries its own fee profile, liquidity constraints, and risk‑return dynamics, making professional guidance important before allocation.

Industry Growth and Future Prospects

Institutional adoption has accelerated private credit’s acceptance as a mainstream asset class. Many major asset managers now offer private credit strategies, and regulatory frameworks have gradually adapted to accommodate broader investor participation.

If the current market backdrop — characterized by cautious equity sentiment and low public bond yields — persists, private credit may continue to attract inflows from retirement savers seeking yield enhancement. However, its performance through various economic cycles will be closely watched as a test of resilience.

Conclusion: A Strategic Tool, Not a Silver Bullet

Private credit’s rise reflects a broader shift in investor preferences toward alternative income sources in an era of low yields and market uncertainty. For retirement portfolios, it presents an intriguing option that can complement traditional stocks and bonds. Yet its illiquid nature and higher credit risk mean that it should be embraced thoughtfully, with attention to individual financial goals and risk tolerance.

As financial landscapes evolve, private credit may become a core component of diversified retirement strategies, offering retirees a blend of income potential and portfolio balance in a changing economic environment.

Leave a Reply