Washington, D.C. — Inflation in the U.S. increased slightly in August, according to the Consumer Price Index (CPI), pushing the annual inflation rate to 2.9 percent, the highest since early 2025. The data has fueled debate over when — and how aggressively — the Federal Reserve will cut interest rates.

What the CPI Data Shows

- On a year-over-year basis, overall consumer prices rose by 2.9 percent in August, up from a 2.7 percent increase in July.

- Core inflation, which excludes volatile food and energy prices, also remained elevated at about 3.1 percent for the same period.

- Month-to-month inflation was measured around 0.4 percent, slightly above economists’ expectations.

What’s Driving the Inflation

- Services related to travel — including hotel stays and airfares — saw significant price increases, suggestive of a rebound in travel demand and consumer willingness to spend post-pandemic.

- Food and housing costs continue to weigh on household budgets, contributing strongly to the core inflation measure.

Economic & Market Reactions

- Stock market indices showed modest gains or held steady in response. Investors appear split between concern over sticky inflation and hope that the Fed will still move toward rate cuts.

- Treasury yields dipped slightly, reflecting anticipation that interest rates may be trimmed, though fears persist that cuts may be delayed due to inflation not cooling fast enough.

- The U.S. dollar softened somewhat as inflation data suggested that price pressures remain outside the comfort zone of central bankers.

Implications for the Federal Reserve

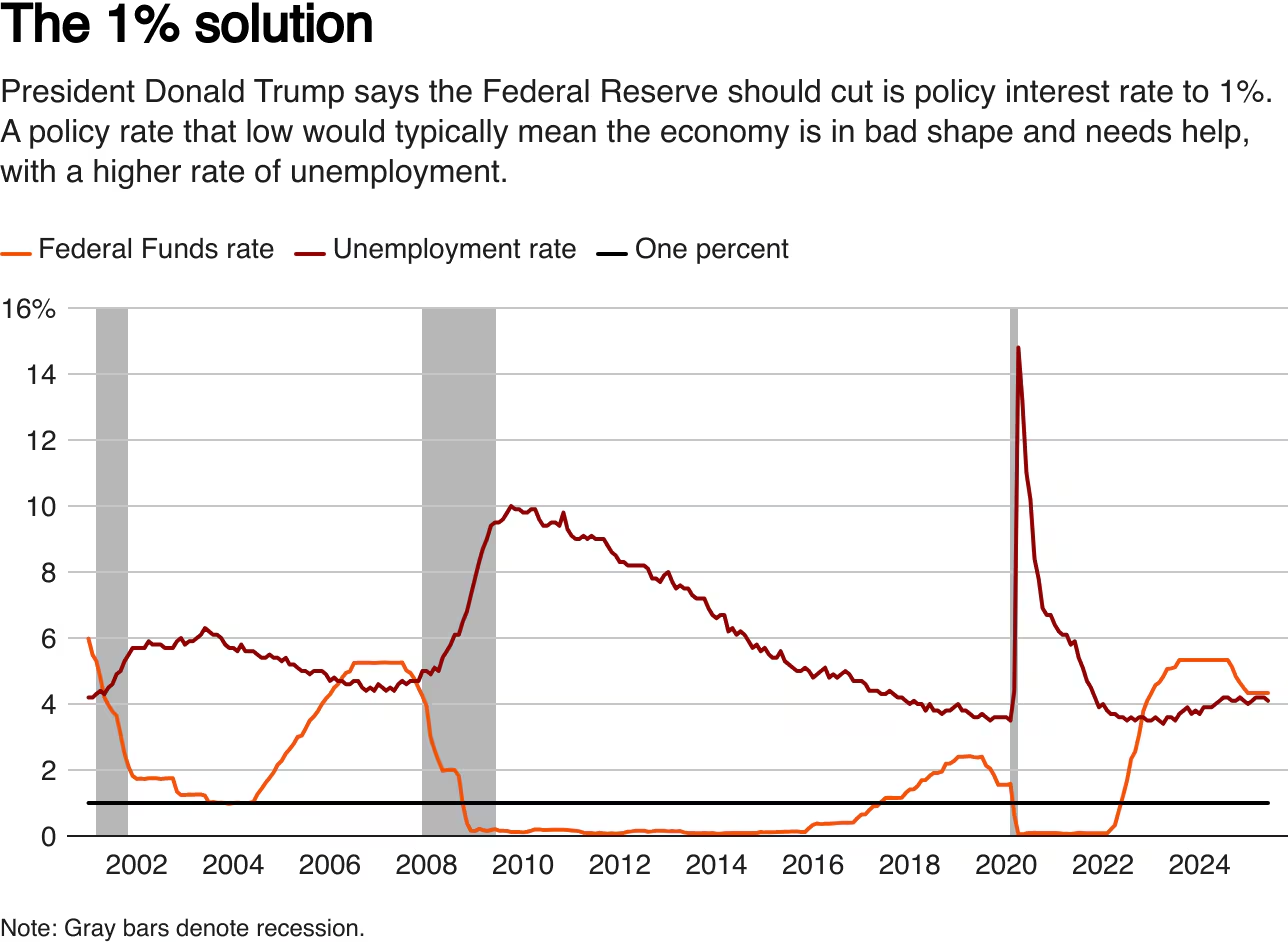

- The data complicates the Fed’s outlook: while inflation is above its long-term 2 percent target, there are growing signs of weakness in the labor market.

- Many analysts believe the Fed will proceed with a modest rate cut at its upcoming meeting, but the timing and size of any cut remain uncertain. Inflation above target could limit how far the Fed can ease without risking another upward spike in prices.

What to Watch Next

- Upcoming labor market reports, especially unemployment claims, which could tip the balance in favor of either a more aggressive or more cautious Fed.

- Inflation in the shelter sector and continued trends in travel and food prices, which may prove persistent.

- Consumer spending in the coming months — if inflation continues to erode purchasing power, retail and service sectors could feel the squeeze.

Leave a Reply