In a sober and unflinching assessment of the current financial landscape, Jamie Dimon, the long-time Chairman and CEO of JPMorgan Chase, has issued one of his most serious warnings to date. Dimon believes that the risk of a significant correction or even a potential crash in U.S. equity markets is far higher than what investors currently recognize. His message comes amid rising valuations, growing geopolitical tensions, and what he calls “the most uncertain global environment in decades.”

Dimon, one of the most respected voices in global finance, said he estimates the probability of a sharp downturn at around 30 percent—nearly triple the risk priced in by most investors. His remarks have sent ripples across global markets, reigniting debate about whether Wall Street’s decade-long rally is nearing a dangerous tipping point.

A Warning from the Top of the Financial Pyramid

Dimon’s words carry unusual weight not only because of his role as the head of America’s largest bank, but also because of his reputation for candid, data-driven assessments. Unlike many market commentators who rely on speculation, Dimon’s perspective is informed by the extensive financial intelligence of JPMorgan Chase — from lending data to credit risk analytics and international capital flows.

He described the current market mood as “unrealistically optimistic,” arguing that investors have grown too comfortable with the idea of perpetual growth. “There’s an assumption out there that markets can continue to climb no matter what happens geopolitically or economically,” he warned. “That’s a dangerous mindset.”

Why Dimon Is Concerned: Multiple Flashpoints at Once

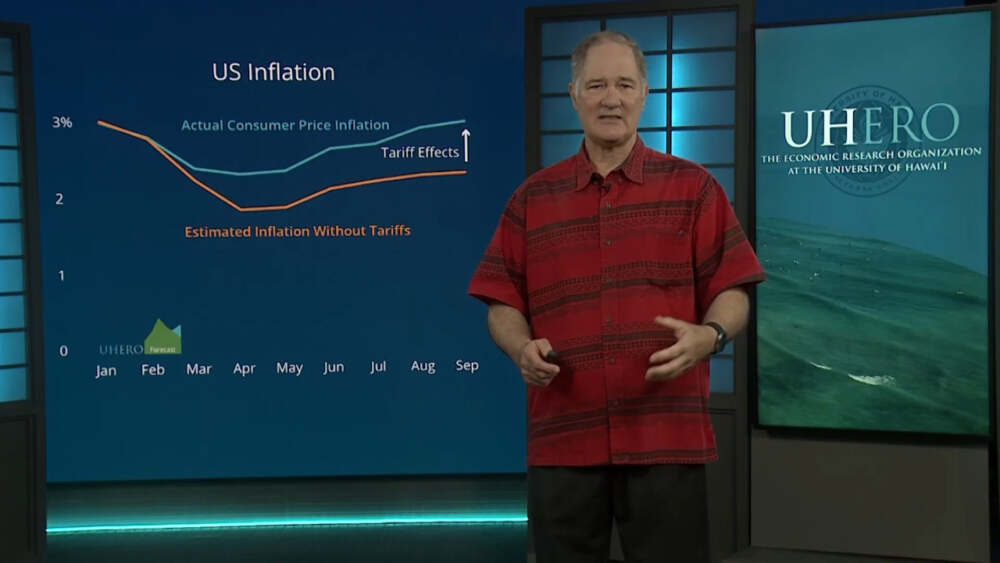

Dimon’s outlook rests on a convergence of global risks rarely seen together. He cited geopolitical instability, fiscal excess, inflationary pressures, and market overvaluation as the main ingredients for potential disruption.

- Geopolitical Flashpoints:

The ongoing wars in Eastern Europe and the Middle East, coupled with rising tensions in the Indo-Pacific, are straining global trade and energy supplies. Dimon warned that these conflicts are “not isolated” and could escalate into broader economic disruptions. - Unsustainable Fiscal Policies:

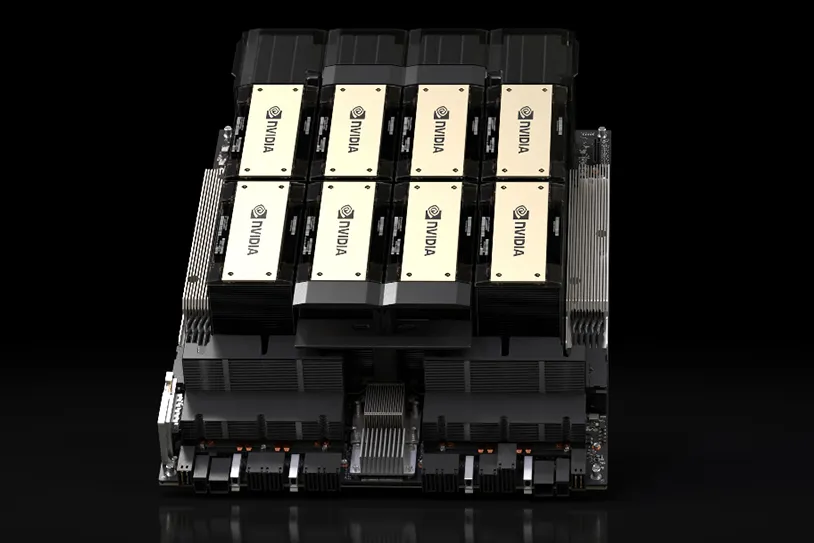

Governments around the world, particularly in the United States, are running historically high budget deficits. “When public debt climbs this fast during peacetime, history suggests consequences,” he said. “You can’t borrow indefinitely without paying the price somewhere — whether through inflation, higher interest rates, or weakened currencies.” - Overheated Valuations:

Dimon expressed concern over excessive enthusiasm in sectors tied to artificial intelligence and emerging technologies. While acknowledging AI’s transformative potential, he likened the current investment surge to the dot-com bubble, noting that “innovation doesn’t mean every company involved will succeed.” - Unknown Unknowns:

Perhaps most importantly, Dimon stressed that financial systems often fail not from the risks we can see, but from those we overlook. “It’s not the things we debate every day that destroy markets,” he said. “It’s the shock no one expects — and right now, there are too many possibilities.”

A Call for Realism, Not Panic

Despite the stark warning, Dimon did not predict immediate collapse. Rather, he urged policymakers and investors to prepare for volatility. “The next few years may not bring catastrophe, but they will test resilience,” he said.

His remarks align with a growing chorus of cautious voices across the financial world. Several major institutions have issued reports warning that U.S. equity valuations appear stretched, particularly given slowing economic growth and the potential for renewed inflationary pressures.

Dimon’s assessment, however, stands out for its balance. He acknowledged the underlying strength of the American economy — robust employment, innovation, and consumer spending — but argued that these strengths cannot justify ignoring risks. “I’m optimistic about America’s long-term future,” he said, “but short-term complacency is how markets get blindsided.”

Reactions on Wall Street

Dimon’s warning has triggered immediate discussion among economists, traders, and corporate leaders. Many view his comments as a timely reminder of the cycle of greed and fear that has long defined financial markets.

- Hedge funds and institutional investors have reportedly begun re-evaluating exposure to high-valuation tech stocks.

- Retail investors, who flooded the market in the last few years, are being urged by advisors to consider diversification.

- Bond markets, meanwhile, saw a small uptick in demand as some investors sought safer assets following Dimon’s remarks.

Market analysts say Dimon’s comments could serve as a turning point — a psychological marker that tempers excessive risk-taking.

A Broader Message on Global Uncertainty

Beyond the U.S., Dimon’s remarks highlight the fragility of the global economy. He pointed to realignments in international trade, a surge in military spending, and deglobalization trends as factors complicating growth prospects. “The world is entering a new era,” he noted, “where security concerns, energy access, and political fragmentation are reshaping markets faster than economists can model them.”

He warned that while technology continues to advance rapidly, it cannot fully offset the drag of geopolitical instability and debt accumulation. “Technology can create efficiency,” Dimon said, “but it can’t neutralize poor policy.”

Lessons for Investors: How to Navigate a Riskier Market

Dimon’s message was not just a warning — it was also a blueprint for prudent investing. He suggested that both institutions and individuals should take a more disciplined approach:

- Reduce Overconcentration: Investors heavily weighted in technology or AI stocks should diversify across sectors and regions.

- Increase Liquidity: Maintaining cash or cash equivalents allows flexibility when markets swing.

- Watch Central Bank Policy: Shifts in interest rates or bond yields remain the single most influential market driver.

- Invest in Fundamentals: Focus on companies with strong balance sheets, consistent earnings, and real cash flow.

- Plan for Volatility: Sharp corrections can create opportunities for disciplined buyers — but only those prepared in advance.

History as a Guide

Dimon’s perspective is shaped by decades in finance, having guided JPMorgan through the 2008 global financial crisis, the pandemic shock of 2020, and multiple recessions. His record lends credibility to his latest warning. “Crises always look impossible before they happen and obvious afterward,” he reflected. “The best time to prepare is before the storm hits.”

Financial historians often note that markets tend to ignore warnings from industry veterans until volatility strikes — and then look back with hindsight clarity. Whether Dimon’s latest caution proves prescient or premature, it underscores a reality often forgotten during bull runs: markets are cyclical, and complacency is their greatest enemy.

A Cautious Optimism for the Future

Dimon ended his remarks with a characteristically balanced outlook. “We’ve survived far worse,” he said, “and America will continue to innovate and thrive. But right now, we need to be humble. The world is changing faster than most investors realize, and that means risk management, not blind optimism, should be the priority.”

As Wall Street digests his message, one thing is clear — the coming months will test whether investors have learned from the past, or whether they will once again ignore the signs of a market running ahead of reality.

Leave a Reply