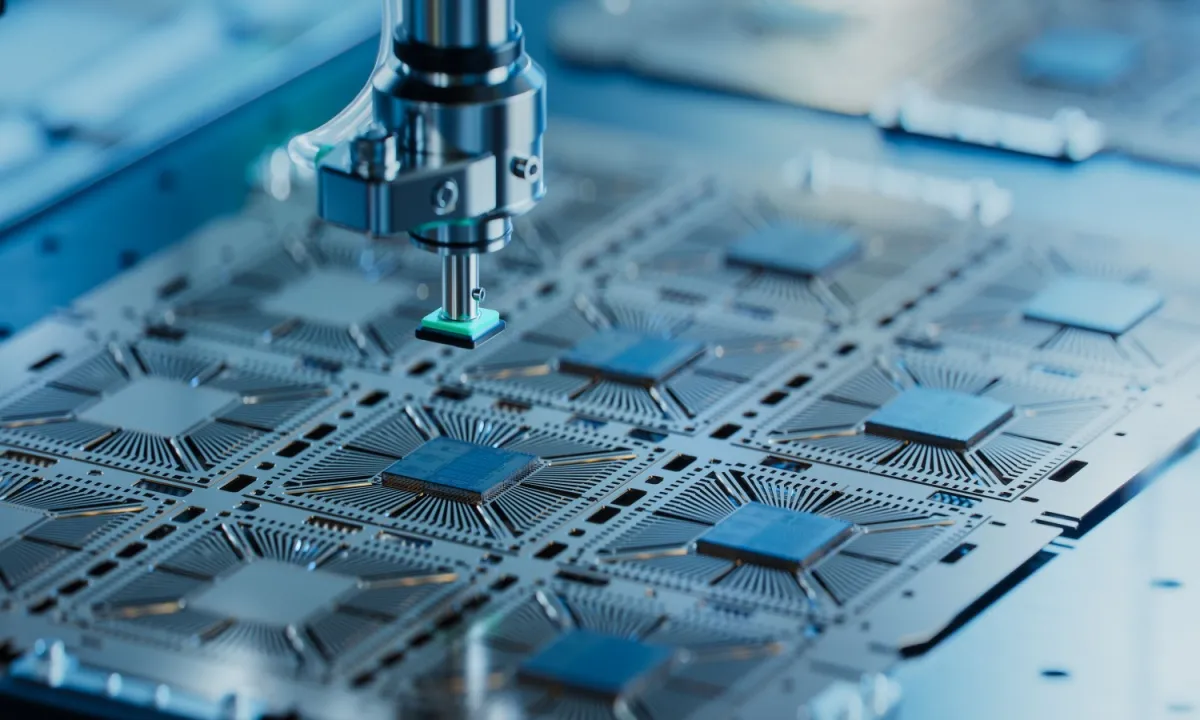

Major technology companies are raising alarms about a potential memory-chip shortage driven by skyrocketing demand for artificial intelligence (AI) infrastructure. Industry leaders including Dell, HP, and Lenovo have highlighted that the global supply of DRAM and NAND memory — essential components for computers, servers, and AI data centers — may not keep pace with the rapid expansion of AI workloads.

What’s Driving the Shortage

The surge in demand is largely fueled by AI applications requiring massive computing power. Training large language models, AI analytics, and cloud-based AI services consume far more memory than traditional consumer or enterprise computing. This shift has put enormous pressure on memory-chip manufacturers to prioritize supply for AI infrastructure, leaving less available for personal computers, laptops, and consumer electronics.

The situation is compounded by supply chain constraints and global competition among tech firms to secure inventory, prompting some companies to stockpile chips in anticipation of higher prices and tighter availability.

Impact on PC Makers and Consumer Electronics

Dell and HP have both signaled that rising memory costs could affect device pricing and availability. Memory accounts for a significant portion of the cost of modern PCs and laptops, and higher chip prices may lead to increased retail costs for consumers. Lenovo has also reportedly increased its inventory of memory modules to buffer against potential supply disruptions.

Consumer electronics beyond PCs, including smartphones, tablets, and gaming consoles, are likely to be affected as well. Automotive electronics, medical devices, and other industries that rely on memory chips could see rising costs and delays in production.

Industry Response

Memory-chip manufacturers, especially in South Korea and Taiwan, are benefiting from high demand, with some raising prices substantially. Device makers are exploring several strategies to mitigate the impact, including:

- Adjusting configurations to use less memory per device.

- Sourcing chips from multiple suppliers to diversify risk.

- Prioritizing higher-margin devices or AI-ready systems that can absorb higher component costs.

Analysts predict that these measures may partially offset the impact, but consumers should expect higher prices and potential delays on certain products through 2026.

Broader Implications

The shortage illustrates how AI development is influencing global supply chains in unexpected ways. As companies invest heavily in AI infrastructure, traditional technology markets may experience ripple effects, affecting affordability and access. Consumers in emerging markets, in particular, may encounter higher prices for budget-friendly devices.

The memory-chip crunch also highlights the growing importance of planning and inventory management in the tech sector. Companies that secure memory supplies early are likely to maintain competitive advantages, while others may face production bottlenecks.

Looking Ahead

The next year will be critical for both memory-chip suppliers and tech companies. Market dynamics, new production capacity, and evolving AI demand will determine how severe the shortage becomes and how long elevated prices persist. Consumers, meanwhile, may need to adjust expectations regarding pricing and availability for PCs, laptops, and other memory-intensive devices.

Conclusion

AI-driven growth is reshaping the technology landscape, but it comes with supply-chain challenges. Memory chips, a vital component of modern computing, are at the center of a potential shortage that could affect both enterprise infrastructure and consumer products. With demand outpacing supply, tech giants are preparing for a year of higher costs, careful inventory management, and strategic prioritization — signaling that the effects of AI expansion are being felt far beyond data centers.

Leave a Reply