A bold shift in industrial policy as the White House targets emerging technologies

In a significant policy pivot, the U.S. federal government is reportedly in discussions with several quantum-computing companies to exchange federal funding for ownership stakes. The initiative forms part of the administration’s broader effort to assert control in industries deemed critical for economic competitiveness and national security.

Who and what: the players and the plan

Companies under discussion include some of the most prominent names in the quantum-computing space—firms such as IonQ, Rigetti Computing and D‑Wave Quantum are reported to be negotiating terms with the U.S. Department of Commerce that could see the government assume a shareholder role. Other companies—such as Atom Computing and Quantum Computing Inc.—are also said to be exploring similar arrangements.

According to sources familiar with the plans, the minimum funding each company might receive is around US$10 million, in return for new equity arrangements or other forms of ownership. In theory, this means the government would not simply provide grants or contracts—but would obtain a stake in the future upside of these companies’ success.

Why now? The strategic imperatives

Quantum computing is viewed by Washington as a transformational technology—one that promises to leap ahead of classical computing by solving complex problems far beyond traditional capabilities (such as ultra-fast simulations for materials science, chemistry, cryptography and optimization). By acquiring stakes, the government aims to:

- ensure that the United States remains a leader in the quantum race, especially vis-à-vis geopolitical competitors;

- have greater visibility and influence over companies working on sensitive technologies (including encryption, national security applications and supply-chain dependencies);

- shift from taxpayer subsidy to taxpayer stake, arguing that when the public invests, the public should share in the returns.

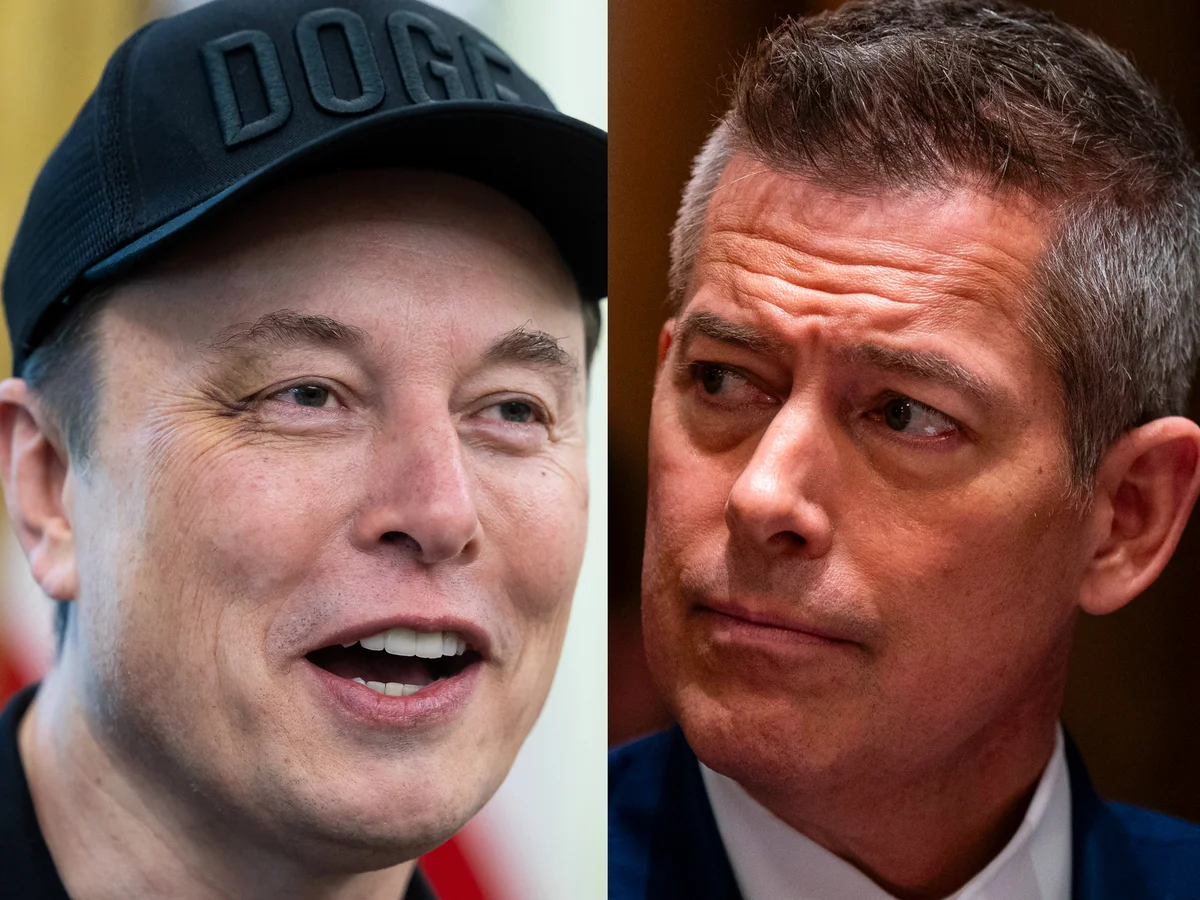

This approach builds on precedent: earlier in the year, the government converted billions in previously awarded grants to an equity stake in a major chipmaker, suggesting a pattern of direct ownership rather than traditional assistance.

Market reaction and industry implications

News of the talks electrified the market. Shares of the companies involved jumped significantly—some by 10-15% or more—reflecting investor hope that deeper government involvement will unlock new funding, contracts and long-term stability for firms that are still technology-heavy and revenue-light.

For the industry, this brings both opportunity and risk. On one hand, the influx of government money and the implied imprimatur of official backing could accelerate research, product development and commercialization. On the other hand, government involvement sometimes brings regulatory or oversight burdens, potential conflicts of interest, reduced agility and questions of whether private-sector innovation will be diluted by public-sector priorities.

Risks, controversies and open questions

Multiple unanswered questions remain:

- Final deal structure: It is unclear whether equity stakes will be straight ownership, warrants, revenue-sharing agreements or a hybrid model. The specific terms will matter greatly for the companies and their other investors.

- Valuation and governance: What price will the government pay? Will it have board seats or veto rights? What kind of influence will it exert? How will this affect a company’s ability to raise additional private capital?

- Innovation incentives: Some worry that heavy state involvement could reduce risk-taking or push companies toward government-driven timelines rather than pure innovation-led paths.

- Competitive distortions: If the government takes stakes in select companies, how will this affect smaller players or international rivals? Will it concentrate power rather than democratize the field?

- National-security vs commercial tension: Because quantum technology has both civilian and military implications, companies will need to navigate dual-use concerns, export controls, data classification and regulatory compliance in new ways.

Broader context: U.S. industrial policy and global competition

This move is part of a broader shift in U.S. industrial strategy. Rather than simply funding basic research, the government is increasingly taking ownership positions in key technological sectors. Some analysts see this as a recognition that future competitiveness in fields such as semiconductors, advanced materials, artificial intelligence and quantum computing will depend on scale, coordination and state-backed industrial ecosystems.

Internationally, this development sends a message: the U.S. is not content to remain a user of advanced technologies—it aims to be the owner, the developer and the controller of leading-edge platforms. In a world where advanced computing power underpins everything from drug discovery to cryptographic defense, that ambition carries weight.

What comes next

In the coming weeks and months, attention will focus on several developments:

- Whether publicly announced terms emerge and how companies respond.

- How private investors and venture capital funds react—whether they view this as a signal of significant support or as an undesirable state intrusion.

- Whether other countries respond in kind—either by offering similar government stakes or by accelerating their own quantum-computing ecosystems.

- Whether these partnerships translate into tangible technological breakthroughs and commercial applications, rather than just symbolic announcements.

Conclusion

The reported initiative by the U.S. government to acquire equity stakes in quantum-computing firms marks a striking evolution in industrial policy. It blurs the traditional lines between public funding and private ownership, placing the state directly into the shareholder seat in companies that promise to define the next technological frontier. Whether this approach will pay off—and whether it will foster innovation rather than stifle it—remains to be seen. But one thing is clear: quantum computing has moved from the lab and venture capital realm into the heart of national strategy.

Leave a Reply