The U.S. stock market opened the week with a mix of cautious optimism and uncertainty, as investors positioned themselves ahead of a critical week packed with economic indicators, corporate earnings, and the Federal Reserve’s highly anticipated interest rate decision. Trading activity was characterized by modest gains in major indices, reflecting the market’s delicate balance between growth expectations and risk concerns.

Major Index Performance

On Monday, the S&P 500 ETF (SPY) traded at $657.41, registering a slight decline of 0.02%, signaling investor hesitation ahead of policy announcements. The Dow Jones ETF (DIA) slipped to $459.32, down 0.57%, while the tech-heavy Nasdaq 100 ETF (QQQ) experienced a moderate increase to $586.66, up 0.47%. The divergence between the indices highlights investor focus on technology and growth stocks, which often benefit from accommodative monetary policy.

Federal Reserve and Monetary Policy Outlook

All eyes are on the Federal Reserve, which is expected to announce its first interest rate cut of 2025 later this week. Analysts suggest that the Fed’s decision will hinge on recent economic data, including inflation trends, employment figures, and consumer spending. A rate reduction could provide a boost to equities by lowering borrowing costs and supporting corporate investment, yet it may also signal concerns about slowing economic growth. Market participants are carefully weighing the implications, as even subtle language from the Fed could trigger significant moves in equities, bonds, and the U.S. dollar.

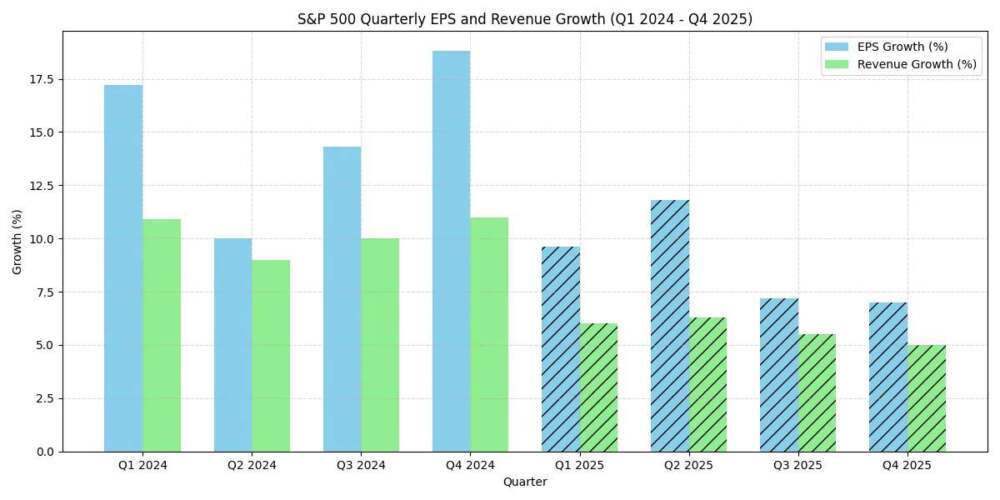

Corporate Earnings and Sector Performance

The corporate earnings calendar adds another layer of market sensitivity. Major companies such as Nvidia, Tesla, and Corteva are scheduled to report their quarterly results, and investor expectations are high. Strong earnings could reaffirm confidence in the corporate sector and offset broader economic concerns, while disappointing results may fuel volatility. Technology and consumer discretionary sectors remain under close scrutiny, given their sensitivity to interest rates and consumer demand patterns.

Global Trade Considerations

Beyond domestic factors, international developments are influencing market sentiment. U.S.-China trade negotiations, currently in their second day, remain a critical focal point. Investors are monitoring progress in discussions on tariffs, technology exports, and supply chain disruptions. Any indication of unresolved tensions could heighten risk aversion, particularly in sectors heavily exposed to international trade such as manufacturing, technology, and energy.

Sectoral Trends and Market Drivers

- Technology: The tech sector continues to lead gains, buoyed by expectations of supportive Fed policy and strong earnings from leading firms.

- Energy: Oil prices remain sensitive to geopolitical developments, affecting energy-related equities.

- Financials: Banks and financial institutions are responding to interest rate forecasts, with potential gains tied to widening spreads in a lower-rate environment.

- Consumer Staples and Discretionary: These sectors are reacting to inflation data and consumer spending trends, serving as bellwethers for broader economic resilience.

Investor Sentiment and Market Outlook

Market sentiment remains mixed. On one hand, investors are encouraged by the potential for an accommodative Fed stance and strong corporate earnings. On the other, concerns about inflation persistence, slowing economic growth, and geopolitical uncertainties—including trade tensions—continue to temper optimism. Analysts recommend a measured approach, emphasizing portfolio diversification and a focus on sectors poised to benefit from both policy support and economic resilience.

Conclusion

The U.S. stock market is entering a pivotal week, with multiple forces converging to influence investor behavior. The Federal Reserve’s interest rate decision, corporate earnings reports, and international trade developments are likely to drive volatility and present both risks and opportunities. Investors are advised to closely monitor these variables, maintain strategic diversification, and be prepared for short-term fluctuations while keeping a long-term perspective.

As the market navigates this uncertain terrain, September 2025 could prove to be a defining period for U.S. equities, setting the tone for the remainder of the year.

Leave a Reply