U.S. stock markets roared to new highs this week, buoyed by the Federal Reserve’s decision to cut interest rates and a surge in semiconductor shares following a landmark investment in the technology sector. The rally, which pushed all three major indexes higher, reflects a renewed wave of optimism that monetary easing and innovation in critical industries will keep the economy on a steady growth path.

A Market Moved by the Federal Reserve

The Federal Reserve lowered its benchmark interest rate by a quarter of a percentage point, marking the first rate cut this year. While modest, the move was widely interpreted as a signal that the central bank is willing to provide more support to the economy in the months ahead.

The rate cut lowers borrowing costs across the economy, offering relief to households with variable-rate loans, businesses looking to expand, and investors searching for higher returns. Lower rates often make stocks more attractive relative to bonds, and this time was no exception: equities rallied while bond yields retreated.

Investors are betting that the Fed is entering a new phase of monetary policy, one that balances the need to control inflation with the recognition that high borrowing costs could slow growth. Futures markets now price in the possibility of additional cuts before year’s end, further fueling bullish sentiment.

Technology Leads the Way

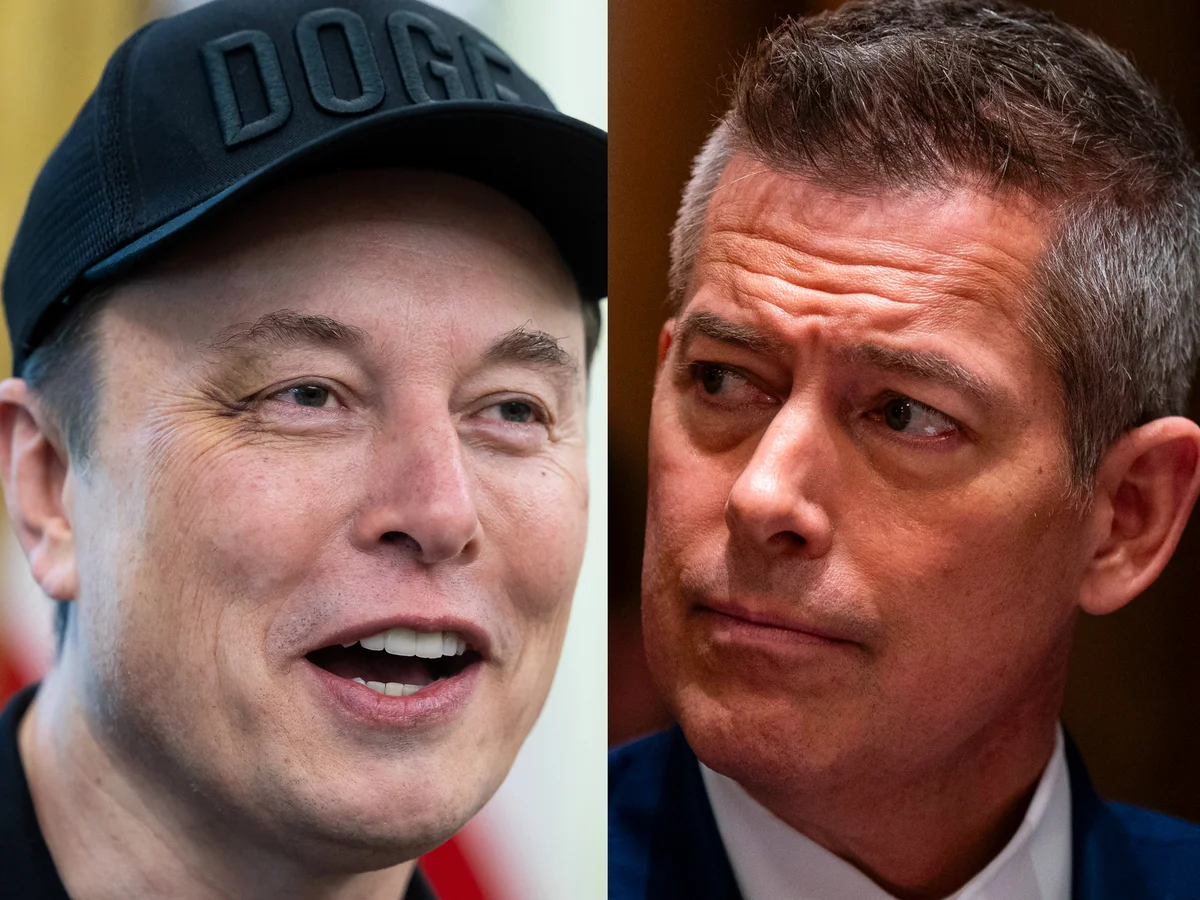

The technology sector, long the driver of Wall Street’s biggest rallies, once again took center stage. Intel shares skyrocketed after Nvidia announced a multibillion-dollar investment into its operations. The move was seen as a powerful vote of confidence in semiconductor innovation, and Intel posted its largest single-day percentage gain in decades.

Nvidia, a company that has dominated headlines in the artificial intelligence boom, also recovered ground after recent volatility. Other chipmakers and tech firms climbed in sympathy, reinforcing the sector’s central role in the broader market’s performance.

Beyond semiconductors, large-cap technology stocks such as Apple, Microsoft, and Alphabet advanced, helping to lift the Nasdaq to its strongest finish in months.

Small Caps Join the Rally

Interestingly, it was not just big tech that benefited. Small-cap companies, often overlooked during the mega-cap dominance of the past few years, surged on the back of the Fed’s decision. The Russell 2000 index, which tracks these smaller firms, reached its highest level in years.

Smaller businesses tend to be more sensitive to interest rates since they rely more heavily on borrowing to finance operations. A lower cost of credit gives them breathing room, and investors appear to believe that a friendlier financing environment could boost their earnings outlook.

Economic Data Reinforces Confidence

Fresh economic data also contributed to the positive mood. Jobless claims dropped, indicating continued resilience in the labor market. Manufacturing activity, which had shown signs of weakness earlier this year, came in stronger than expected. Meanwhile, inflation readings suggested that price pressures are easing, reducing fears that the Fed will need to tighten policy again soon.

Bond yields fell as investors adjusted to the possibility of more rate cuts ahead. The 10-year Treasury yield slipped, a development that makes equities look even more appealing relative to fixed-income securities.

Risks and Caution Flags

Despite the rally, analysts caution that markets are not without risks. Valuations in the technology sector remain stretched, and any disappointment—whether in earnings, demand, or regulation—could spark a sharp correction.

Inflation remains a wild card. If future reports show price pressures picking up again, the Fed may be forced to hold back on additional cuts, dampening investor enthusiasm. Similarly, geopolitical tensions and global trade frictions continue to pose threats, particularly for semiconductor firms that rely heavily on cross-border supply chains.

Some analysts also warn that markets may be “front-running” the Fed, pricing in a faster pace of cuts than the central bank is ready to deliver. If those expectations are not met, investors could face a painful repricing.

The Bigger Picture

For now, Wall Street appears to be embracing a Goldilocks scenario: inflation cooling, economic data holding up, and monetary policy turning supportive. With record closes across multiple indices, momentum remains firmly on the bulls’ side.

The rally underscores how quickly sentiment can swing once investors believe the Fed is back in easing mode. It also highlights the continued power of technology—especially semiconductors—as a driving force in modern markets.

Whether this surge marks the beginning of a sustained bull run or simply a temporary burst of enthusiasm will depend on the balance of economic data and policy signals in the weeks ahead. For now, though, investors are enjoying the ride as Wall Street scales fresh record highs.

Leave a Reply