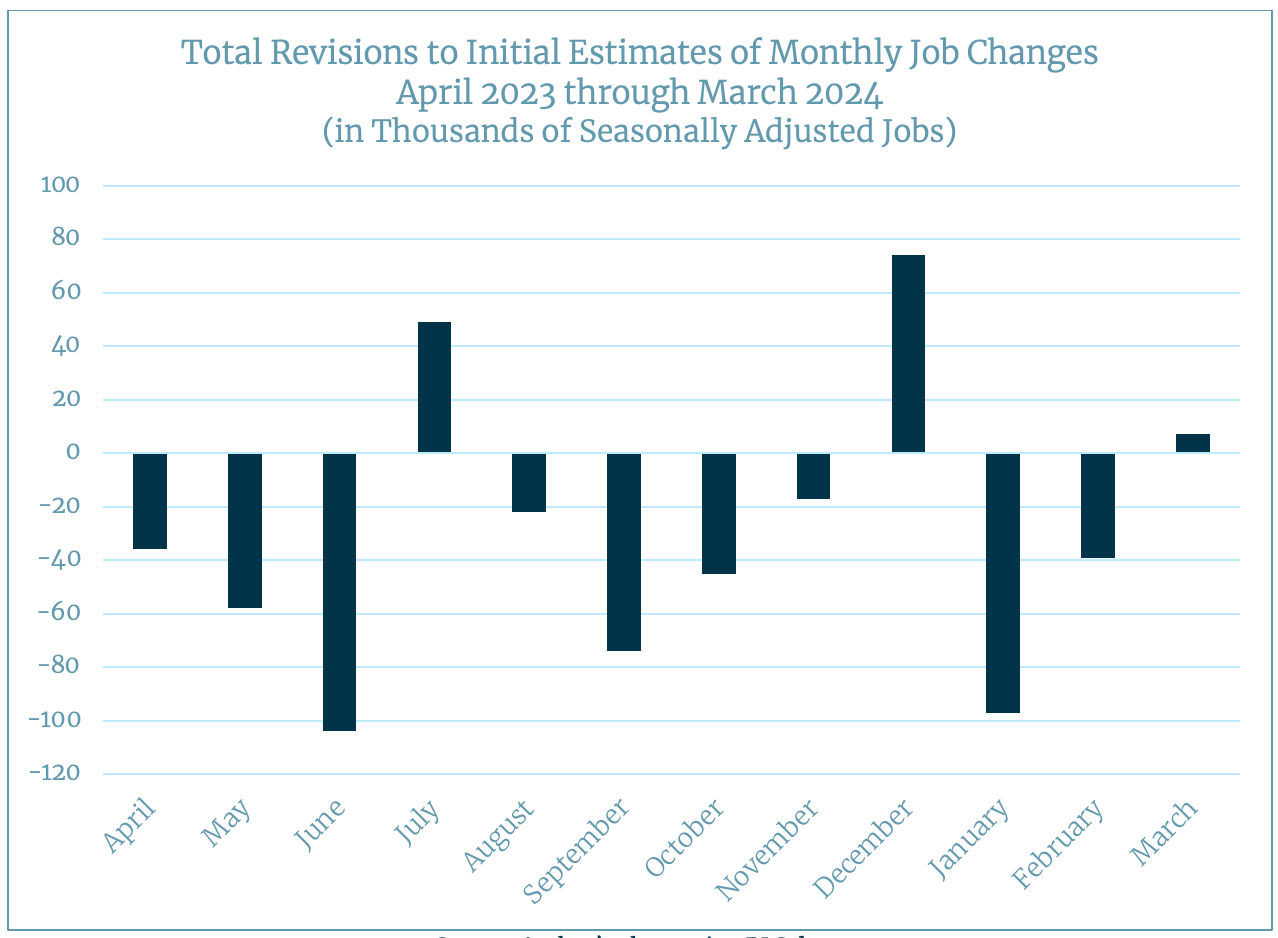

Washington, D.C., September 9, 2025 — The Bureau of Labor Statistics (BLS) has issued its annual benchmark revision, revealing that the U.S. economy created far fewer jobs over the past year than initially reported. The adjustment shows that employment growth may have been overstated by as much as one million positions, a finding that paints a weaker picture of the labor market and intensifies debates over economic policy.

Job Growth Overstated

According to preliminary figures, payroll growth between March 2024 and March 2025 was significantly lower than earlier estimates suggested. Instead of the average monthly gain of around 165,000 jobs that had been reported, the true figure may have been closer to 100,000. This revision indicates that the labor market slowdown began earlier and was more pronounced than policymakers and investors believed.

Economists warn that such a dramatic adjustment underscores fragility in the job market, with hiring momentum clearly losing steam even before this summer’s weaker monthly data.

Political Shockwaves

The revision immediately sparked political fallout. Democrats criticized President Trump’s economic management, arguing that aggressive tariffs and restrictive immigration policies have hurt hiring and dampened business confidence. They also condemned recent attempts by the administration to replace BLS leadership, warning that political interference in statistical agencies undermines credibility.

Supporters of the president counter that the slowdown reflects a necessary transition period as trade and manufacturing policies are restructured to favor long-term domestic growth.

Markets and the Fed React

Financial markets were cautious following the news. While stocks held steady, bond yields dipped as investors bet that the Federal Reserve will soon be forced to cut interest rates. A weaker labor market provides the central bank with room to ease policy in order to support growth.

Economists widely believe that the Fed could begin reducing rates as soon as its next meeting, given the combination of cooling employment and persistent inflationary pressures.

Sluggish Hiring Already Evident

Recent data had already raised concerns. August’s jobs report showed only 22,000 new positions were added, one of the weakest monthly readings in years. Combined with the newly revised figures, the trend points to a clear loss of momentum, shifting the narrative from a robust recovery toward one of economic stagnation.

Concerns Over Data Integrity

Beyond the numbers, the revisions have reignited debates about the independence of the BLS. The agency has faced growing scrutiny after the dismissal of its commissioner earlier this year, a move critics said was politically motivated. Economists caution that any erosion of trust in official data threatens both investor confidence and policymaking decisions.

A Crossroads for the Economy

The revelations put the U.S. economy at a crossroads. While some argue that the slowdown is temporary and will be offset by structural reforms, others fear it may mark the beginning of a deeper downturn. The coming months will test whether policymakers can stabilize growth without undermining credibility in the institutions responsible for guiding economic strategy.

Leave a Reply